Property & Conveyancing

The buying and selling of freehold and leasehold property

Velile Tinto has a progressive and entrepreneurial practice in property and conveyancing alongside our other branches of law. As the Attorneys in the conveyancing department are able to draw on their many years of property experience, we are able to provide comprehensive and cutting edge assistance whether we are representing an adviser, bank, developer, property owner or occupier or other institutional client.

Whether you are buying or selling your property we will ensure that you are fully familiar with the entire Process. You will mostly be dealing with three different attorneys when buying or selling your property, namely:

1) Transfer Attorney

2) Bond Attorney

3) Bond Cancellation Attorney

Conveyancing Services

One of the Biggest in SA

At Velile Tinto & Associates our edge and what sets us apart is that we are solution orientated

Velile Tinto & Associates, attended to various bulk transfers of all PIP’s conducted on behalf of First National Bank (2500 transfers), Saambou Bank (900 transfers), Mercantile Bank Limited (160 transfers), and Standard Bank South Africa Ltd.

Our Experience

Excellent service

Velile Tinto head hunted highly experienced and motivated staff. Our staff has conveyancing experience exceeding 300 years

They are experienced enough to draft deeds manually, a skill rarely found today in our industry. “Success lies with the person and not the task”… a company policy adopted by all staff.

Our vast team of highly accomplished attorneys whose unrivaled knowledge and extensive experience ensures that any issue can be resolved immediately.

6 Sigma

What sets us apart

Very high percentages of instructions received by attorneys have some form of error. This ranges from a spelling mistake to more significant issues.

All clients are contacted within 24 hours of receipt of instruction to verify details. This practice ensures that all our information and documents are One Hundred Percent Accurate, thus preventing unnecessary delays.

Bond Registration Process

How to get started

A Client will often require funds to assist in the purchasing of a property, or to improve their existing property, or to consolidate his or her debt. In order to cater for their needs they will go to a Bank for a loan

Follow these steps to acquire the funds you need :

Step 1: Apply for a home loan

The client will apply for the amount required to purchase their property

Step 2: Attorney Firm Receives Instruction from the Bank

Receive the instruction from the Bank and contact the client to acknowledge receipt of the bond instruction.

Step 3: Preparation of Bond Documents

The Bond attorney will request all the necessary documents from the transferring attorneys and client to enable them to draft the documents for the client to sign.

Step 4: Signature of Documents

As soon as all the documents are drafted and ready to be signed, the attorney will set up an appointment with the clients to sign the relevant documents and to discuss payment of bond registration costs.

Step 5: Guarantees & FICA

Guarantees will be send to the Transferring Attorney and all the documentation will be send to the Bank in terms of their compliance receive a “proceed” which enables the attorney to lodge at the Deeds Office.

Step 6: Lodgement at the Deeds Office

When the bond registration is linked to a transfer, the Transferring Attorney will notify you when lodgement will take place. You cannot lodge until you receive your “may proceed” from the Bank.

The Examination process takes on average between 10 to 15 working days, before the deeds will come up for registration in the prep room.

Step 7: Registration

The bond is registered from 10:00 in the morning by the Bond Attorney in the Execution Room.

On registration ownership of the property is transferred to the Purchaser, the Seller’s existing bond is cancelled (if applicable) and the Purchaser’s bond is duly registered in favour of the Bank.

On day of registration, the client and the Bank is informed accordingly.

Step 8: Delivery of Title Deed

After registration takes place the deeds are numbered and micro-filmed at the Deeds Office.

This can take up to 3 months. Once the title deed is delivered to the Transferring Attorney they will send it to the Bond Attorney who will in turn send it to the Bank. The Bank retains the title deed as security for monies lent and advanced.

Bond Cancellation Process

Selling your property or paid up your bond

A separate act of cancellation is required in the Deeds Office.

- The fact that your bond is paid up with the bank doesn’t automatically result in the cancellation of the bond at the deeds office. A separate act of cancellation is required in the Deeds Office.

- You will need to give the bank at least 90 days (3 months) early settlement notice of your intention to cancel your existing bond, failing which penalty interest will be charged.

- The Seller/client is responsible for payment of the cancellation costs.

Step 1: Cancellation Process

Instructions received from transferring attorney to apply for cancellation figures at the respective banks.

Step 2:

Request send to bank

Step 3:

Bank issue cancellation figures which are sent to the transferring attorneys with our cancellation requirements.

Step 4:

Bank send title deed & mortgage bond (Referred to as security documents) – a copy of the title deed is sent to the transferring attorneys.

Step 5:

Receive guarantee from transferring attorneys

(Guarantees are issued to ensure that there are funds available to cover the outstanding bond on date of cancellation).

Step 6:

Lodge

Step 7:

Prep

Step 8:

Registration

Step 9:

Bank will refund any Credit/Excess to client

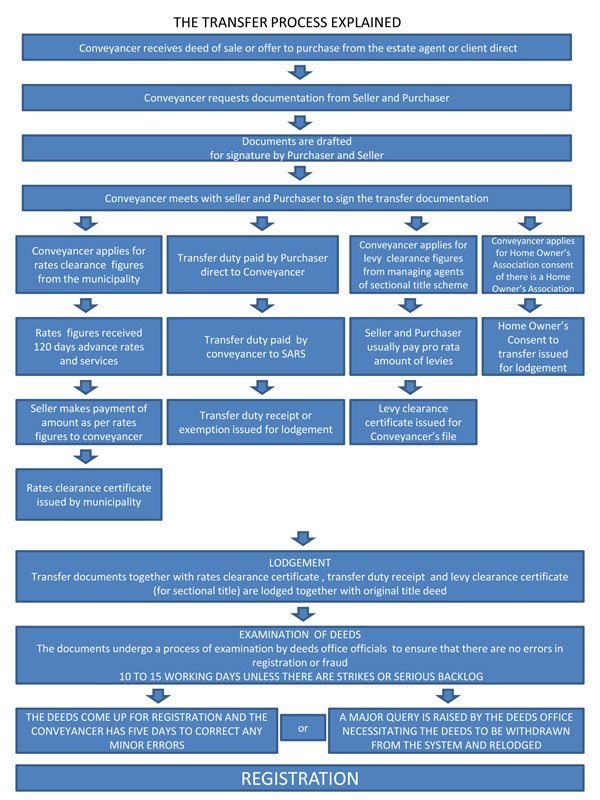

The Transferring Proses

Buying or selling property

is the biggest financial commitment most of us will ever undertake.

It is thus very important that the Estate Agent and Conveyancers are chosen carefully. The Estate Agent will explain the terms of the sale agreement to the parties – who must ensure that they ask questions and understand all the terms before signing the agreement. Once the agreement of sale is signed, it is a binding contract between the Seller and Purchaser.